As a result, these companies easily gain the trust of reputed financial institutions. But, companies with good LFCF can easily seek credit from external sources. Thus, negative levered free cash flow does not affect business operations-operating cash flow can still be positive. Capital expenditure can be a significant sum, but it pays off in the long run. The LFCF need not always be positive since it accounts for the deduction of capital expenditure.

#FREE CASH FLOW FORMULA HOW TO#

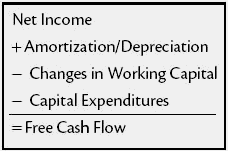

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked Moreover, firms use this money (if retained) for new projects, business expansion, and future opportunities. LFCF is the amount retained or distributed among the stakeholders as dividends-after clearing capital expenditure and mandatory debts. Shareholders and investors rely on LFCF to gauge a company’s long-term growth and ability to generate profits. LFCF builds shareholders’ confidence-it indicates that money is invested in the right place. The levered free cash flow (LFCF) meaning implies a crucial figure in a company’s accounting books. LFCF = Earnings Before Interest, Taxes, Depreciation, and Amortization + Net Change in Working Capital – Capital Expenditure – Mandatory Debt Payment. The formula to evaluate the LFCF is as follows:.On the contrary, Unlevered Free Cash Flow is defined as the money possessed by a company before clearing debts.But capital expenditure pays off in the long run. Because sometimes, a negative LFCF is a mere indication of significant capital expenditure. Even if the LFCF is negative, the company can have a positive operating cash flow.The levered free cash flow (LFCF) is a financial indicator that reflects the money left with a business entity after clearing mandatory debts and financial obligations.

0 kommentar(er)

0 kommentar(er)